missouri gas tax bill 2021

With 65 billion on the way from the federal infrastructure bill and a newly increased gas tax Missouri is ready to take. The tax will go up 25 cents a.

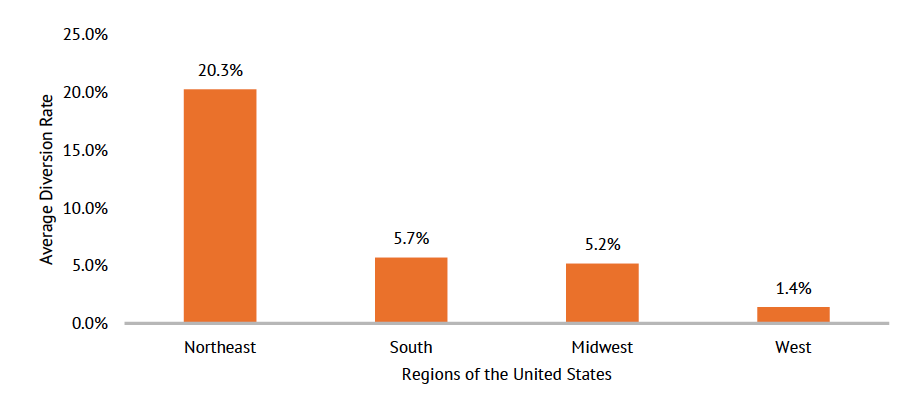

How Much Gas Tax Money States Divert Away From Roads Reason Foundation

The legislation includes a rebate process where drivers could get a refund if they save their gas receipts and submit them to the state.

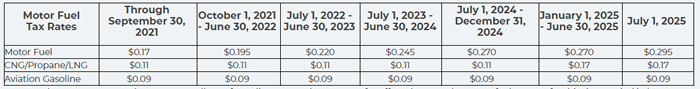

. In addition to a gas tax increase last October Missouris motor fuel tax rate is set to bump up by 25 cents per gallon annually on July 1 through 2025. May 12 2021. By Kaitlyn Schallhorn on July 13 2021.

Schatzs bill is projected to raise an extra 500 million annually. Submitted by Brent Hugh on Wed 05122021 - 500am. The measure will gradually raise the states 17-cents-per-gallon gas tax by 125 cents over the next five years.

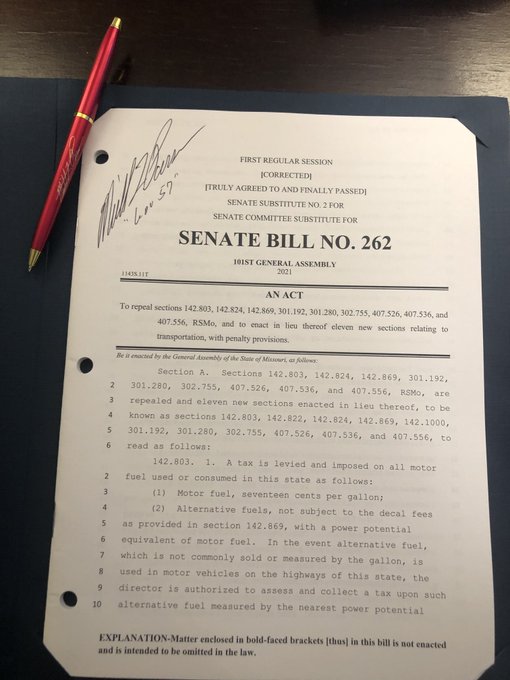

A passion project for Senate President Pro Tem Dave Schatz the legislature gave the final approval for his SB 262 during the final week of session. The taxpayer will multiply 15265 by 0195 15265 x 0195. Today the Missouri Legislature passed a 125 per gallon fuel tax increased to be phased in at the rate of 25 cents per year from 2021 to 2025.

The increases were approved in Senate Bill 262. The tax will increase an additional 25 cents per gallon in each fiscal year until reaching an additional 125 cents per gallon on July 1 2025. Mike Parson greenlit an incremental gas tax increase Tuesday bumping it up to 295 cents by 2025.

A taxpayer purchases 15365 gallons of gasoline on October 25 2021 for off road usage. The bill raises Missouris 17-cent-a-gallon gas tax among the lowest in the nation by 25 cents a year starting Oct. At the end of 2025 the states tax rate will sit at 295 cents per.

The tax is set to increase by the same amount yearly between 2021 and 2025. Rudi Keller - November 12 2021 700 am. Under the bill passed by lawmakers taxpayers would have gotten a one-time tax credit of up to 500 for individuals and 1000 for couples.

Beginning in October 2021 when the new law kicks in an additional 25 cents per gallon tax on motor fuel in Missouri will be collected. The first of five annual gas tax increases of 25 cents per gallon takes effect reaching a total increase of 125 cents by 2025. Come July residents who filed a 2021 state tax return and earned under 75000 annually or under 150000 for joint filers will receive a rebate of 250 or 500 beginning in July.

While the bills language is currently being. Missouri Legislature passes 125 cent gas tax increase phased in over four years - headed to Gov for signature and its done. Patrick McKenna director of the Missouri Department of Transportation speaks at the I-70 Bridge groundbreaking ceremony on Oct.

Couples filing jointly with incomes under 400000 will receive 100. Missouris current tax is 17 cents per gallon on all motor fuels including gasoline diesel and. 12 2021 in Rocheport photo courtesy of Missouri Governors Office.

Refund claims must be postmarked on or after July 1 but no later than September 30 following the fiscal year for which the refund is claimed. Schatzs Senate Bill 262 would increase Missouris gas tax by 125 cents per gallon by 2025. MoDOTs current fuel tax rate generated about 692 million in 2020.

The bill passed in 2021 says Missouri drivers who keep their gas receipts between October 1 2021 and June 30 2022 can request a full refund of the additional taxes paid. Starting July 1 Missouri residents can apply online to get a refund for a portion of the states two and a half cent fuel tax as part of Missouris fuel tax rebate program. Missouris fuel tax rate is 17 cents a gallon through September 30 2021 for all motor fuel including gasoline diesel kerosene gasohol ethanol blended with gasoline biodiesel B100 blended with clear diesel fuel etc.

Use this form to file a refund claim for the Missouri motor fuel tax increase paid beginning October 1 2021 through June 30 2022 for motor fuel used for on road purposes. Parson proposed a special legislative session focused on cutting Missouris individual income tax rate which is 54 for most taxpayers to around 47. Current Bill Summary.

The motor fuel tax rate for this time period is 0195 per gallon. Missouri bill would boost gas tax but offer rebates to drivers February 9 2021 By Alisa Nelson A proposed fuel tax increase could come with a. 1 until the tax hits 295 cents per gallon in July 2025.

R-Maysville speaks on the Missouri House floor on March 4 2021 file photo courtesy of Tim. SS2SCSSB 262 - This act modifies provisions relating to transportation. Tax filers will also receive 100 per dependent they claimed on their 2021 taxes up to three dependents.

MOTOR FUEL TAX Sections 142803 142822 and 142824 This act enacts an additional tax on motor fuel beginning with 25 cents in October 2021 and increasing by 25 cents in each fiscal year until reaching an additional 125 cents per gallon on July 1 2025. The taxpayer has paid 298 in motor fuel tax and may request a refund of that amount using Form 4923. 2021 the date Missouri first.

The refunds would have gone only to. Missouris gas tax would increase for the first time in decades under a bill passed late Tuesday by the GOP-led Legislature. Schatzs Senate Bill 262 increases Missouris gasoline tax by 125 cents per gallon by 2025.

Cash Rich States Are Slashing Taxes Amid Revenue Windfalls

How Much Gas Tax Money States Divert Away From Roads Reason Foundation

Who Qualifies For A 1 400 Stimulus Payment Under The House Bill

Parson Greenlights Gas Tax Increase The Missouri Times

Save Your Receipts Refund Available For Increased Missouri Gas Tax Marshfield Mail

Parson Greenlights Gas Tax Increase The Missouri Times

Parson Greenlights Gas Tax Increase The Missouri Times

Why States Continue To Overrule Local Regulation Of Fossil Fuels

Parson Greenlights Gas Tax Increase The Missouri Times

Cash Rich States Are Slashing Taxes Amid Revenue Windfalls

Parson Greenlights Gas Tax Increase The Missouri Times

Cash Rich States Are Slashing Taxes Amid Revenue Windfalls

Parson Greenlights Gas Tax Increase The Missouri Times

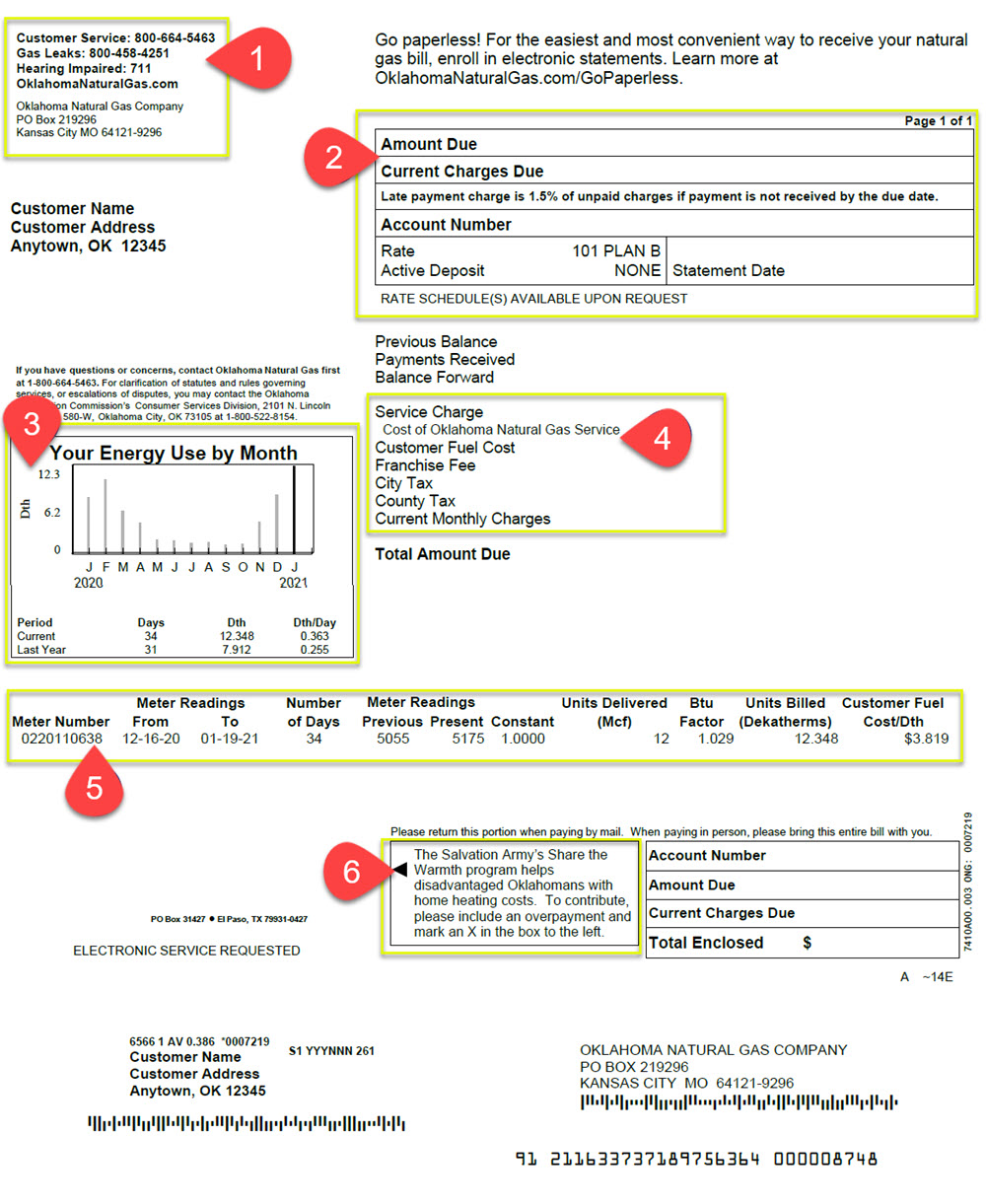

Oklahoma Natural Gas Understand Your Bill

Kansas Income Tax Calculator Smartasset

Here S Where Sc Ranks For Most Expensive State Gas Tax In The Nation

/cloudfront-us-east-1.images.arcpublishing.com/gray/WUCACT55PRFCPC6SHZXPHWKEQA.jpg)